Integrated 401(k) Plans

Reinventing the 401(k)

Integrated 401(k) plans make it easy and affordable to help your employees save for retirement.

(K)ickstart Employee Savings

The first 401(k) with 3% cash back on contributions

(k)ickstart your employees’ retirement with:

- 3% cash back on employee contributions (min. $100, max. $250), a special perk for those making $60,000 or less per year

- Education in-product & in our (k)ickstart™ curriculum, a 10-part course designed to guide first-time savers on their financial journey

- Award-winning customer service, enrollment webinars in Spanish & English, and a mobile-optimized experience

RUN YOUR BUSINESS, WE'LL HANDLE YOUR 401(K)

Finally, end-to-end administration

Human Interest takes the hassle out of managing your company’s 401(k). We sync to your payroll, process contributions, and handle all of your compliance testing and IRS paperwork.

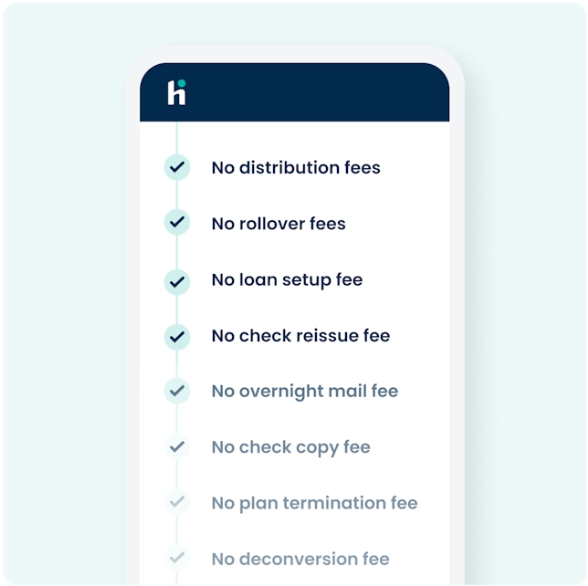

CLEAR, AFFORDABLE PRICING

Zero transaction fees. Period.

Through dozens of sneaky, shady fees, other 401(k) providers can take advantage of you and your employees.

We don’t.

With us, you get affordable plans, low-cost funds, and absolutely no transaction fees.

401(k)s aren't expensive anymore

You can offer retirement benefits for less than the cost of one employee’s health insurance.

BUILT FOR YOU

Flexible, customized retirement plans

We offer Traditional and Roth 401(k)s, 403(b)s, safe harbor plans, and profit-sharing plans — we’ll help you figure out what’s right for you. Employers can customize matching and vesting options at no additional cost.

MODERN RETIREMENT BENEFITS

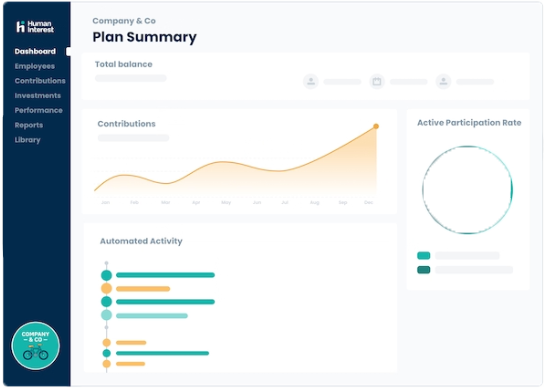

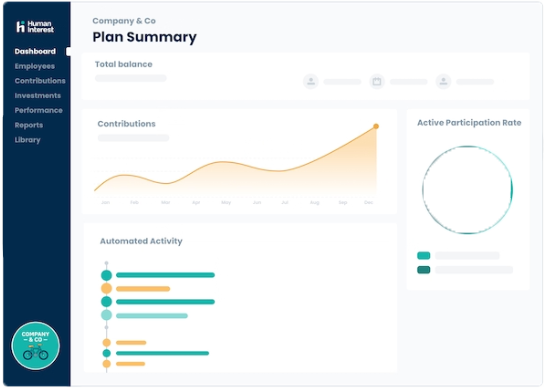

Easy to use interface

Your dashboard gives you a 360-degree view of your company plan, including employee participation and contribution reports. Employees can start saving in a few easy steps with our seamless onboarding and built-in investment education.

Everything you need to support your business

Explore all of our services to find everything you need for your business.

FREQUENTLY ASKED QUESTIONS

What questions do you have?

Review answers to our most commonly asked questions or contact us for more details.

How long does it take to set up a retirement plan for my company?

Employers/Plan Administrators can start a plan in as little as 15 minutes on the web. We send all documents electronically for approval and eSigning.

How much does a 401(k) or 403(b) cost employers?

Employer pricing for plans starts at $120 per month base fee + $4 per employee per month.

If you’re starting a plan for the first time, you may qualify for tax credits.

If you already have a plan, talk to us so we can help you see if you qualify to save money on a deconversion fee.

What investment services do you provide?

Employers and Employees have access to funds from every major asset class and risk category, including those from Vanguard, Dimensional Fund Advisors, TIAA-CREF, and many more.

Plans offer automated investment recommendations based on each individual’s responses to a series of questions. Employees who want more flexibility can choose and manage their own funds. The choice is theirs.

Our digital solution includes education and allows employees to diversify globally, rebalance automatically, and avoid hidden fees.

What tax credits are available to employers?

Businesses starting a 401(k) or other retirement plan may be eligible for tax credits including:

The Retirement Plans Startup Costs Tax Credit, which allows eligible employers to claim 50% of their ordinary and necessary startup costs up to $5,000 per year for up to three years. Employers may choose to start claiming the credit in the tax year before the tax year in which the plan becomes effective. Expenses incurred by employers to educate employees about the plan are also eligible.

There is a tax credit for new and existing 401(k) plans when they add an auto-enroll feature. The value of that tax credit is $500 per year for three years (a total of $1,500).

For more information on tax credits for businesses that offer a 401(k) or to learn more about the tax deductions for offering a 401(k) matching contribution, contact us.

Why should I offer an employer match?

Outside of the tax deductions given to employers for making contributions to their employees’ retirement accounts, the employer match is a powerful recruiting tool to attract top talent.

Do I have to provide an employer match?

No, employers are not required to provide a match, though many do! Matching can be a powerful incentive for both hiring and retaining talented employees and there are major tax incentives for employers that offer a match.

What is a safe harbor plan?

A safe harbor 401(k) plan is a type of tax-deductible 401(k) plan that ensures eligible employees receive a pre-determined employer contribution in exchange for an automatic pass on some annual nondiscrimination tests. The mandatory employer safe harbor contribution may be in the form of a basic match, an enhanced match, or a non-elective contribution, depending on the plan design. Safe harbor contributions must be 100% vested immediately unless combined with a special automatic enrollment provision (called a “QACA”). QACA contributions may be subject to a two-year vesting schedule.

There are several arrangements an employer can use to provide a safe harbor contribution in a 401(k) plan.

How can you help my employees save for retirement?

We make it easy for employees to save. When given access to our platform, the majority of employees choose to save for retirement with a 401(k).

What should I look for in a 401(k) plan and provider?

We hear from our SMB customers just how important it is to find a retirement savings plan that works for them and their employees. Here are some of the top features of a plan they’re looking for.

A plan that…

Is easy to use for both employees and employers;

Has clear and affordable pricing;

Comes with tools to help guide employees, ranging from trustworthy investment education to financial wellness education to customer support;

Does NOT add to the administrative burden for the employer (including the ability to sync with payroll, help with compliance or employee notification, etc.);

Has flexible plan design, including giving employers the ability to set vesting schedules, matching options, and more;

Has the ability of the plan to scale with a company’s growth;

Will help employees save for the future; and

Will help the employer compete for and retain talent.