Time & Attendance

Streamline your workforce management

Discover how our Time and Attendance solutions can revolutionize your business’s workforce management. From online timekeeping to employee scheduling, we’ve got you covered.

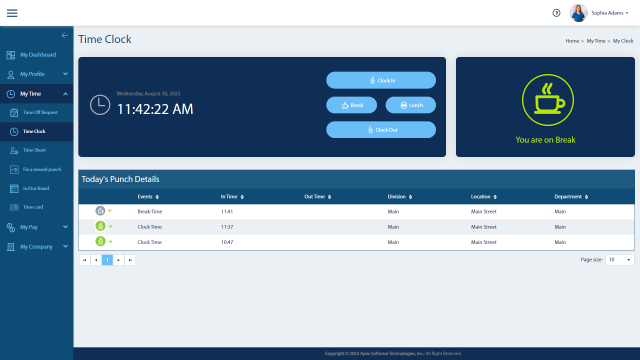

Online Timekeeping

Precise time tracking made easy

Our online timekeeping feature simplifies the process of tracking your employees’ work hours. Say goodbye to manual data entry and tedious spreadsheets. With our intuitive interface, your team can easily clock in and out from any device, whether they’re in the office or working remotely.

This real-time tracking ensures accuracy and eliminates time theft.

- Eliminate the need for paper timesheets

- Get instant access to real-time attendance data

- Track geo-location data on clock punches

PTO/Vacation Time Tracking

Hassle-free PTO and vacation management

Managing paid time off (PTO) and vacation requests can be a headache. Our feature simplifies the process, allowing employees to submit time-off requests online, and supervisors can approve or deny them with ease. You’ll have a clear view of available PTO balances, ensuring efficient resource allocation.

- Streamline PTO requests and approvals

- Reduce scheduling conflicts and enhance employee satisfaction

- Generate reports on PTO accruals and balances

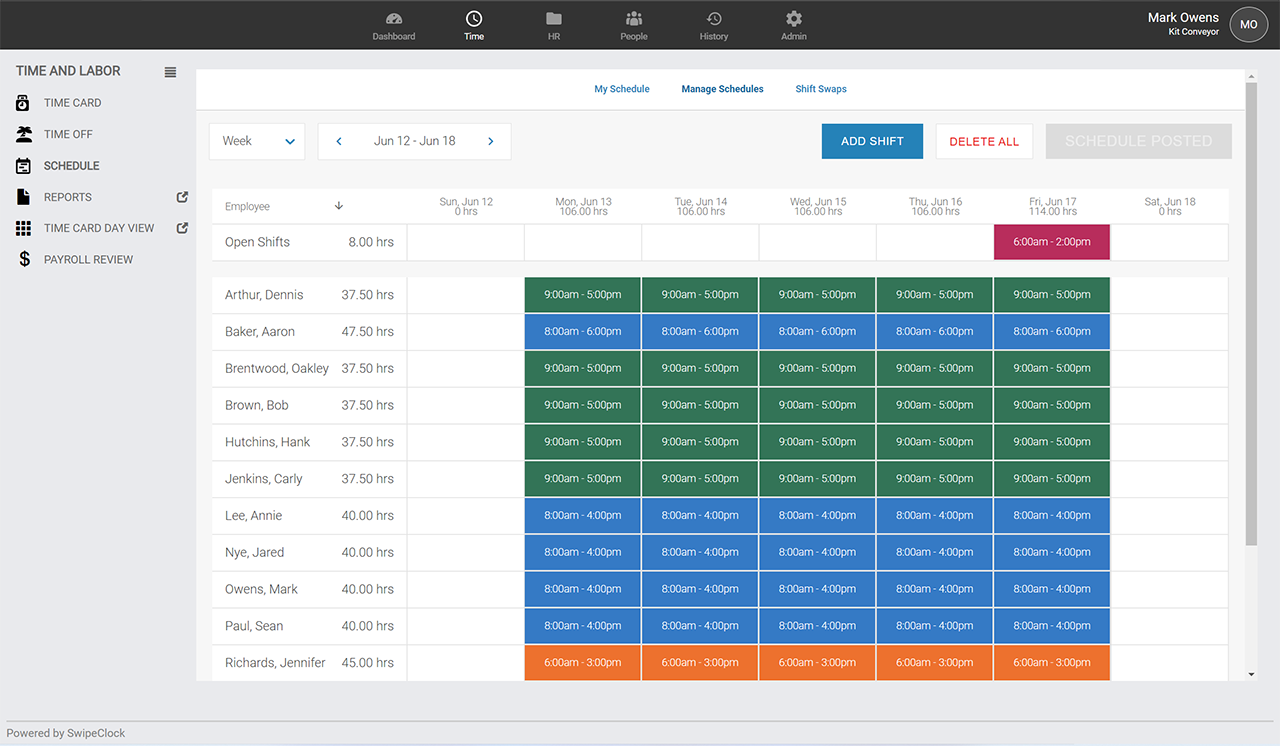

Employee Scheduling

Efficient employee scheduling, every time

Creating employee schedules has never been this efficient. Our feature enables you to build schedules that suit your business needs, taking into account employee availability, skills, and preferences. You can quickly make adjustments, and employees can access their schedules online, reducing confusion and last-minute changes.

- Ensure optimal staffing levels to meet demand

- Minimize scheduling conflicts and overtime costs

- Empower employees with self-service access to schedules

Transform your time and attendance management today

Experience the future of workforce management with our comprehensive time and attendance feature. From online timekeeping to employee scheduling, we offer the tools you need to streamline operations, boost productivity, and enhance employee satisfaction. Say goodbye to manual processes and hello to efficiency.

Time-Off Request Management

Seamlessly handle time-off requests

Our time off request management tool empowers your workforce to request time off without the hassle of paperwork or lengthy email chains. Supervisors can review and make informed decisions quickly. You’ll never miss a beat, ensuring proper staffing levels and employee satisfaction.

- Automated notifications for new time-off requests

- Calendar view of approved and denied requests

- Track time-off history for each employee

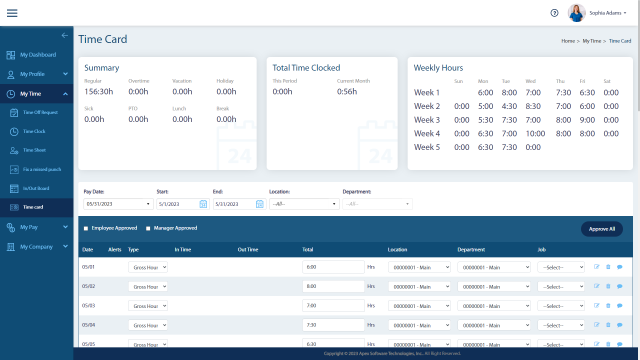

Online Timecards

Digital timecards for effortless records

Ditch the old-fashioned timecards and embrace our digital solution. Our online timecards provide a comprehensive overview of your employees’ worked hours, making payroll processing a breeze. You can easily review, edit, and approve timecards with just a few clicks, ensuring accuracy and compliance.

- Access timecards from anywhere, anytime

- Reduce the risk of errors with automated calculations

- Monitor overtime hours and compliance effortlessly

Everything you need to support your business

Explore all of our services to find everything you need for your business.

FREQUENTLY ASKED QUESTIONS

What questions do you have?

Review answers to our most commonly asked questions or contact us for more details.

What is online timekeeping, and how does it benefit my business?

Online timekeeping is a digital solution that allows employees to clock in and out from any device with internet access. It benefits your business by reducing manual data entry, preventing time theft, and providing real-time attendance data for accurate payroll processing.

How can I ensure accurate time records with digital timecards?

Digital timecards automate time tracking and calculations, reducing the risk of errors. They provide a comprehensive overview of employee work hours, making it easy to review, edit, and approve timecards. This ensures accurate payroll and compliance with labor laws.

Can your system handle PTO and vacation time tracking?

Yes, our system simplifies PTO and vacation time tracking. Employees can submit time-off requests online, and supervisors can quickly approve or deny them. You can also monitor PTO balances and generate reports to efficiently manage paid time off.

How does the time off request management feature work?

Our time off request management tool allows employees to request time off online, eliminating paperwork and email chains. Supervisors receive notifications for new requests, making it easy to review and approve. You can also track time-off history and identify trends in requests.

What benefits does employee scheduling offer my business?

Employee scheduling streamlines the process of creating schedules that fit your business needs. It considers factors like employee availability and skills, reducing scheduling conflicts and overtime costs. Employees can access schedules online, promoting transparency and reducing last-minute changes.