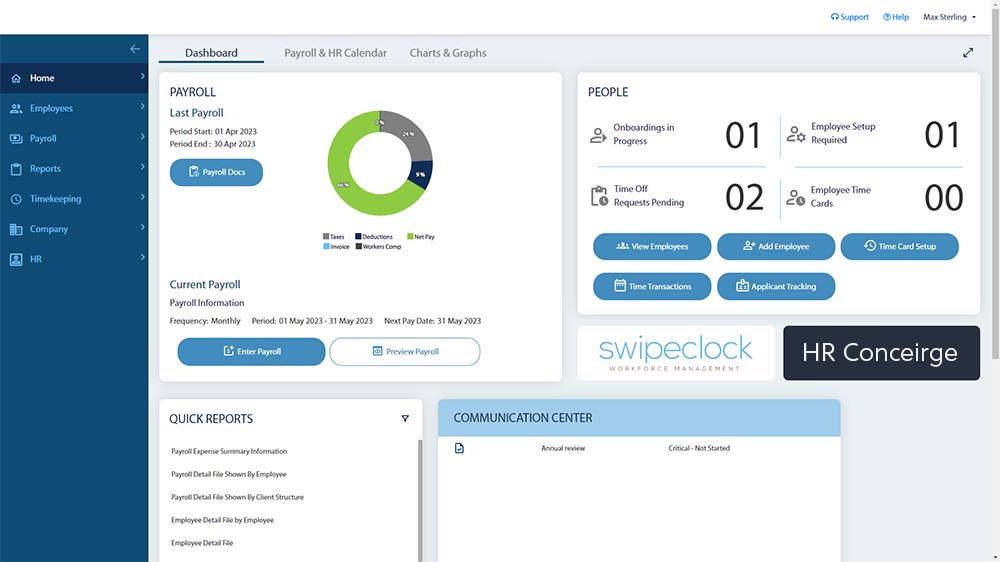

Payroll Processing

Smart, simple payroll you can love

Payroll processing becomes swift, effortless, and convenient. You can enter and approve your payroll online, and our system automatically calculates and manages tax payments and filings.

Streamline Payroll

Full-service payroll processing

Discover the efficiency and ease of our full-service online payroll processing solution. Say goodbye to manual calculations and hello to accurate, hassle-free payroll management. Experience seamless employee compensation, tax filing, and reporting, all in one place.

- Boost efficiency through automation

- Stress-free tax management

- Personalized expert support

Tax Management

Automated tax payments & filings

We automatically pay and file your Federal and State taxes for you. You’ll never have to worry about payroll taxes and you can focus on what matters most – running your business.

- Federal IRS Forms 941 and 940

- State withholding and unemployment insurance

- Federal/State W-2s and 1099s

Reimbursements and Deductions

Reimbursement and deduction management

Conveniently add reimbursements to employee pay. Streamline your payroll process, enhance accuracy, and take the hassle out of managing complex deductions.

- Convenient reimbursements: Automate employee reimbursement calculations and streamline the reimbursement process.

- Effortless garnishments: Handle court-ordered garnishments effortlessly, ensuring compliance with legal requirements and precise deductions from employee wages.

- Benefit management: Easily manage employee benefits by automating deduction calculations for healthcare plans, retirement contributions, and more.

- Employee advances: Simplify the process of providing employee advances, automating the deduction setup and repayment tracking.

Same monthly pricing for all pay cycles

No matter the frequency of your pay cycles – weekly, bi-weekly, semi-monthly or monthly – you’ll pay the same monthly fee. Say goodbye to fluctuating costs and hello to budget-friendly payroll management.

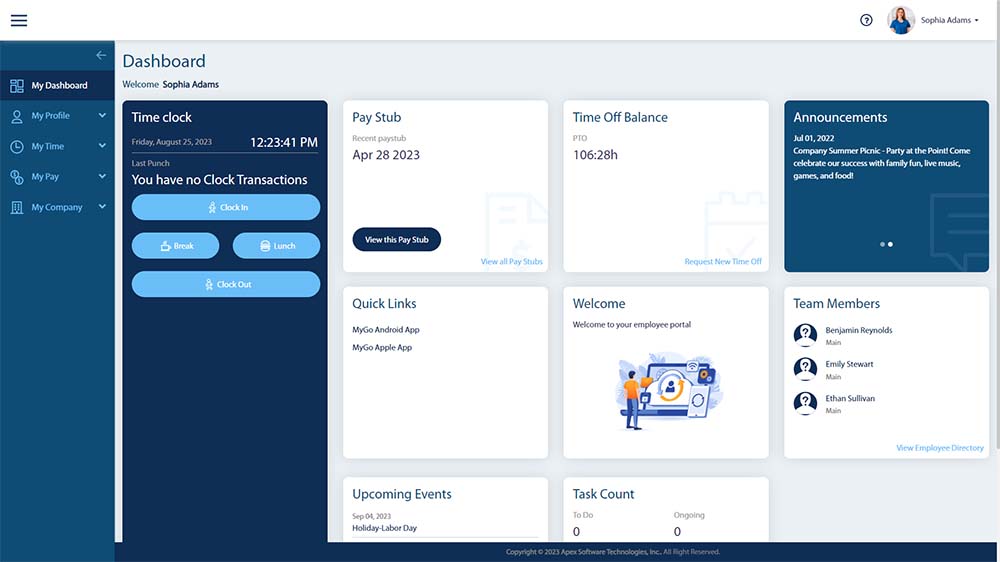

Employee Empowerment

Empower your team with employee self-service

Revolutionize your payroll experience with our user-friendly employee self-service feature. With employee self-service, your team can:

- Access pay stubs and W-2s: Easily view and download pay stubs and tax forms, reducing administrative inquiries.

- Request time off: Streamline time-off requests with automated workflows, ensuring smooth approval processes.

- Check PTO balances: Employees can keep track of their available paid time off, promoting transparency.

- Receive pay day alerts: Get notified about upcoming paydays, helping with financial planning.

Cash Management

Effortless payroll funding and employee payments

Optimize your cash management strategy with our innovative payment solutions. We offer a range of funding and payment choices to suit your business needs, including short-term payroll loans! Say goodbye to delays and hello to timely and accurate employee payments.

- Instant self-print checks: Generate checks on demand, ensuring rapid payment delivery.

- 2-day and 4-day Direct Deposit: Choose the speed that suits your payroll schedule, providing flexibility.

- Same-day and next-day wire-funded Direct Deposit: Expedited processing and lightning-fast transfers, perfect for cash flow management or time-sensitive payments.

- Short-term payroll loans: Cash flow problems can happen to anyone, even thriving businesses. And when you need to make payroll, you need to make payroll, no matter what happens.

Enhanced Services

Elevate your payroll with additional features

Discover a suite of advanced features designed to take your payroll management to the next level. Our online payroll provider service offers a range of additional services that cater to your diverse business needs.

- Enter and approve payroll online: Simplify the entire payroll process from entry to approval, all in one platform.

- Employee Onboarding Assistant: Streamline new employee setup and ensure a smooth onboarding experience.

- Payroll on Autopay: Set up automated payroll processing to save time and reduce manual intervention.

- Multi-state payroll: Handle complex payroll scenarios with ease, ensuring compliance across multiple states.

- Independent Contractor payments: Seamlessly manage payments for contractors, ensuring accurate and timely compensation.

- Custom earnings codes: Tailor your payroll to your business's specific needs with customizable earnings codes.

- Employer accounting integrations: Integrate seamlessly with accounting software for streamlined financial management.

- Expert account setup: We gather your information and setup your payroll account for you.

- US-based customer support: Receive prompt assistance from our knowledgeable support team whenever you need it.

Everything you need to support your business

Explore all of our services to find everything you need for your business.